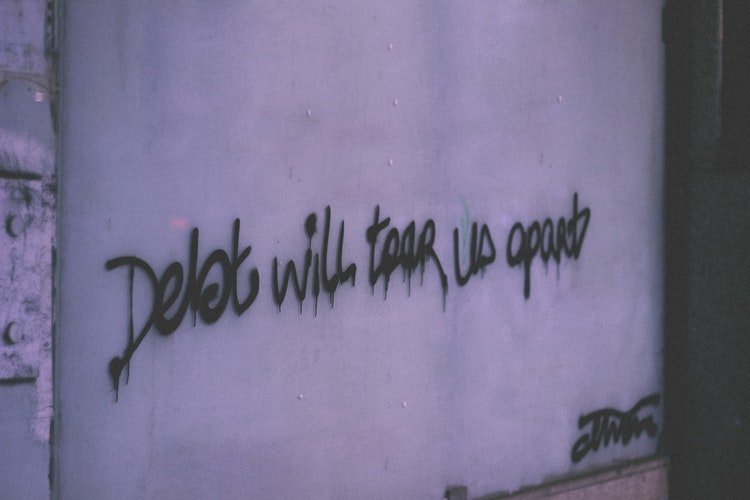

Across the United Kingdom, debt continues to feature, with that latest stats showing 2017s consumer debt totalling £1.6bn. With the figures increasing amid interest rates and inflation rises, it can seem like a bleak forecast, with the tumultuous political climate serving to make things ever volatile. However, debt is a challenge that can be readily managed. Between the multiple government schemes and professional help available, there is light at the end of the tunnel for those embroiled in money worries.

The basic steps to getting out of debt are well established and anyone who takes these initial measures will be in good stead to overcome the challenge. Staying strong is key, and here’s how you can do it and achieve financial security and confidence.

Establishing Your Situation

A lot of debt problems stem from chaotic money management. When your cash flow is very positive looking, it can be tempting to take on credit agreements where the payments seem negligible. However, a missed payment brings late charges, interest and more. In response, you take out more debt with a lower rate, and end up in a catch 22. The government have introduced new measures in December that have sought to break the debt spiral but it remains a factor in debt management. Establishing your baseline is the quickest way to do this. Budget, don’t be afraid to look at your bank account, and seek professional finance help to ascertain the state of your finances. Many companies can assist with overhauling and auditing credit scores, and charities will now lead you through this for free and provide expert advice.

Make A Plan – Stick To It

One of the routes that many people in debt take towards tackling their problem is through DMPs and associated products. Debt management plans are government approved plans that, unlike older forms of debt relief like IVAs and bankruptcy, are not legally binding. They are a voluntary agreement between the creditors and the consumer, often negotiated by charity. The point of these plans, and others like them, are to create a plan where your debt is entirely repaid. However, when left unpaid, they can jeopardise your future efforts at repayment. When you make a plan – through these schemes or individually – ensure that you stick to it.

Keep your chin up, and stay flexible

When your debt has reached a certain level, the amount of payments going in don’t seem to make a dent. It can be disheartening to not see the balance drop quickly, but keep your chin up. Over months and then years, this will reduce, and you’ll see your quality of life increase along the way. If you are struggling, consider looking into mental strength and toughness to keep your mental state in a good place. Stay flexible, too – if you find yourself coming into money, or have a promotion or pay rise, consider using that extra money to get the debt paid off sooner and have the repayments free in the long term.

Debt is a big challenge that, statistically, most debts will face during their life. Whether through mortgages, loans or credit cards, it’s there to be defeated; with hard work, help and perseverance, you can do it.

Author: Oliver Curtis

Hi there. I’m Oliver. I’m just a young boy from the outskirts of… Okay, that’s a lie, I’m not a young boy anymore, although I certainly feel that way at heart.