Baby Boomers, the generation aged between 54 – 72 years old, are one of the most talked about generations of all time when it comes to a lack of retirement planning. Most finance and economics experts believe this generation is so poorly prepared for retirement simply because it does not possess enough funds to lead a happy life post retirement. Experts agree that Baby Boomers may have to make a lot of compromising decisions in order to support themselves during their later years, whether it’s searching for facilities that offer long term care in fullerton or their local area or being able to have enough money to help pay off any debts. Baby boomers may have a lot more to worry about when it comes to retirement than initially realized.

The current situation of Baby Boomers exemplifies the importance of starting to prepare for retirement at an early age and what mistakes to avoid to ensure that you don’t end up without a robust retirement plan.

If you are wondering, and you really ought to be, how you can prepare for your retirement so that you don’t face financial problems post working, read on…

Evaluate Your Current Situation

No matter what your age is, the best way to prepare for your retirement is to start by taking stock of your finances. You have to find out how much money you have saved and invested now and how much you will get from social security and superannuation accounts once you have retired. After you are clear with this, it will become easier to evaluate how much additional money you will require in order to enjoy your retirement. If you are worried that your finances aren’t going to add up, you may have to start considering other options, like whether selling your home could improve your financial situation. This might be a good opportunity to downsize and find that perfect little retirement home by the beach you’ve always dreamt of, or if you’re in a particularly large house that you can’t afford to keep running, you could consider renting part of your spare space.

Set Realistic and Achievable Retirement Goals

The next step is to set realistic retirement goals for yourself. To put it simply, create an estimate of how much money you will need after retirement to lead a happy and hassle free life. Research into 55+ communities in Utah, or wherever you might be looking to spend your retirement, and work out what your realistic budget is. Set yourself a goal to aim for – get excited about the future! Now, deduct the amount that you have already saved and invested in order to find out how much more amount you need to accumulate. Then, you can divide this amount by the number of years of work you have left to figure out how much you should save and invest annually.

Keep in mind that you must ensure that you create your annual saving requirement with respect to your current earnings so that your yearly goals are realistic.

Seek Financial Advice for Your Retirement Years

Thankfully it is easy to find a quality financial consultant as there are many credible retirement planning services out there that can guide you correctly as you move forward making the decisions you will need to make in order to generate the right amount of financial security you both need and deserve by the end of your professional life and before your retirement.

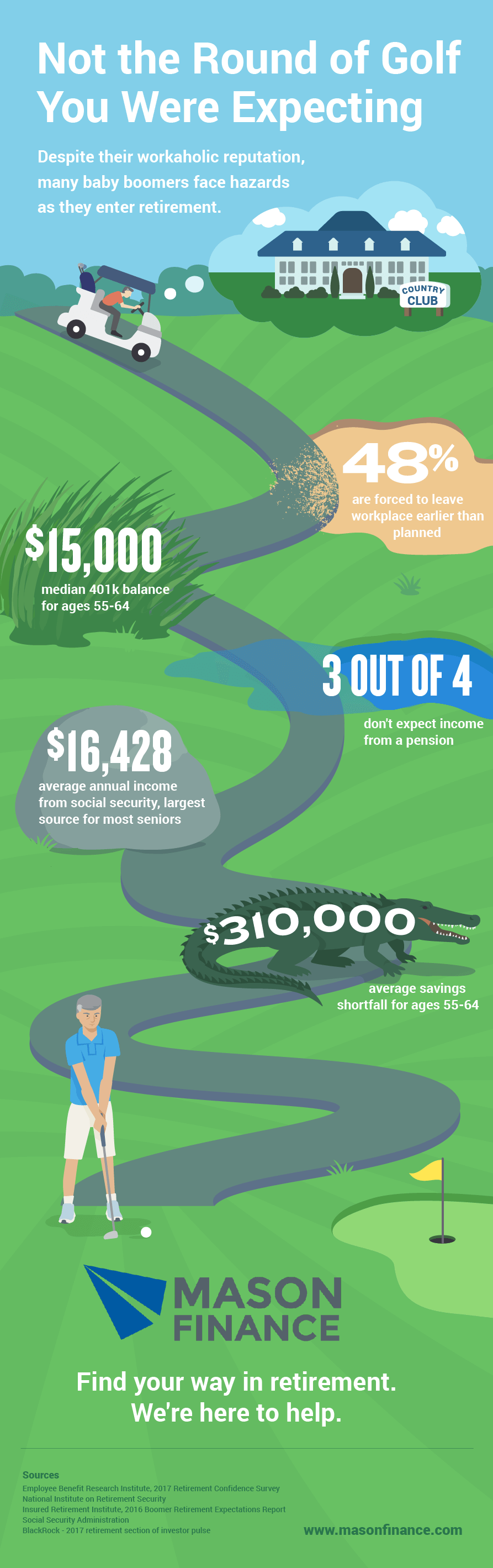

By following these tips, you can save yourself from the problems that so many Baby Boomers are facing with their retirement. Here’s an infographic that will raise your awareness of some alarming facts related to Baby Boomers’ retirement.

Infographic: Baby Boomer Retirement Planning Tips

There are a lot of issues and problems which Baby Boomers are facing with their retirement. Check out this link to learn about some of the common problems facing this generation- https://www.masonfinance.com/blog/baby-boomer-retirement-infographic/

Author: Oliver Curtis

Hi there. I’m Oliver. I’m just a young boy from the outskirts of… Okay, that’s a lie, I’m not a young boy anymore, although I certainly feel that way at heart.